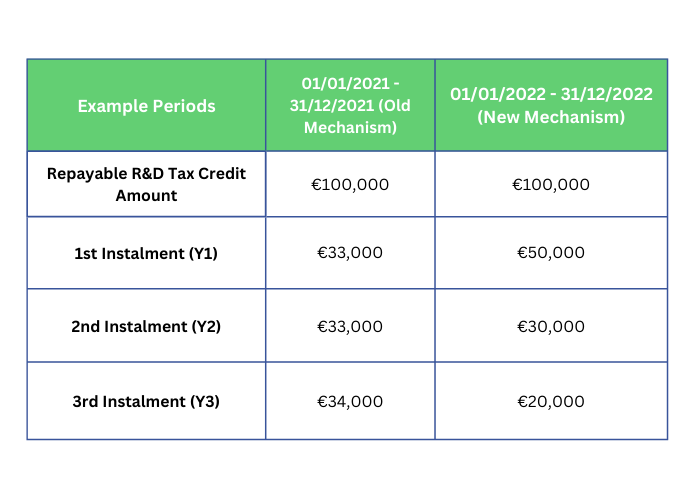

In the ever-evolving landscape of R&D Tax Credit, staying informed about the latest changes is crucial for businesses looking to maximise their financial advantages. We have outlined an overview of the changes in legislation to the Finance Bill, the amendment to the Repayment Schedule, and further additional amendements to guidelines to take into consideration.

Please Note: Companies can opt for accelerated repayment of any remaining credits due under old mechanism during the first claim under 766 C/D. Repayment schedule has been defined for Section 766C/D as the date a valid claim is submitted as part of the CT1 return

As leading R&D Consultants in Ireland and the UK, we help clients ranging from indigenous SME’s to Multinational brands. We can support you through these changes – with advice and guidance or by managing part or all of the process. Contact us for further information: [email protected]

Braithwaite provides Expert R&D Tax Credit advice. We Combined Technical & Financial Expertise to Identify & Maximise your Innovation & Research & Development Tax Credit Opportunities Across Ireland

Dogpatch Labs,

The CHQ Building,

Custom House Quay,

Dublin 1, D01 Y6H7

Ireland

Office: +353 1 964 5325

Email: [email protected]

© Braithwaite Technology Consultants Limited 2025, registered in Ireland (company number 506246)