The enhancements to the Research and Development Tax Credit (RDTC) announced by Minister McGrath as part of the recent budget are significant and have various implications for businesses and the R&D sector.

Here’s a breakdown of the key points:

Braithwaite Ireland have been assisting Irish companies over the past 12 years to leverage the R&D Tax Credit. We oversee the full Science and Accounting Tests by providing Financial Costings and associated Technical Reports to ensure our clients meet the strict criteria set out by Revenue.

To better understand how these changes will benefit Start-ups, Scaling companies and SMEs, here the example of an existing Precision Engineering client who file annually with Braithwaite:

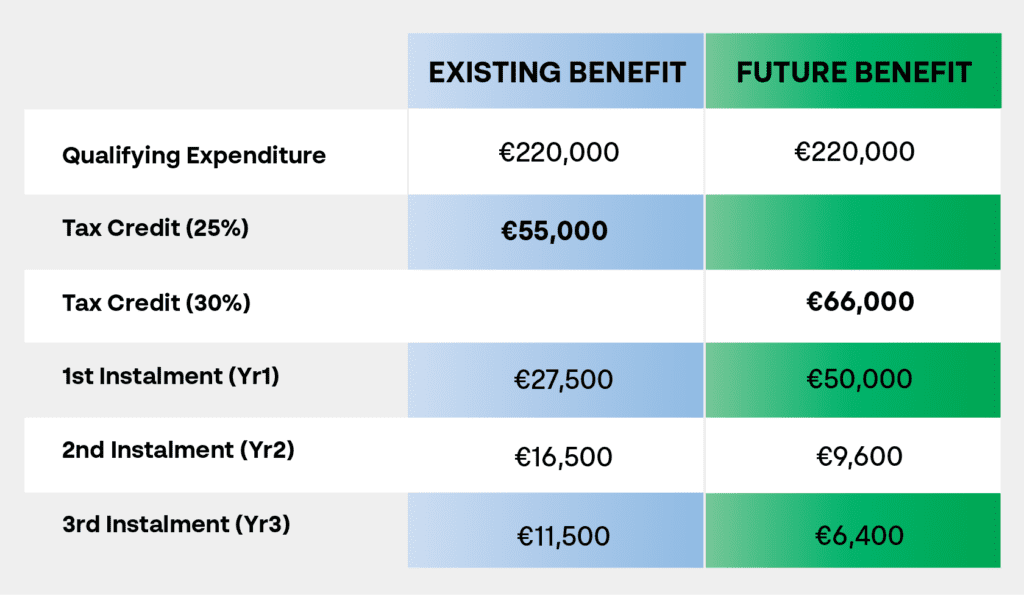

They are now filing their FY2022 claim and have 2 projects which meet the eligibility criteria with €220,000 in related expenditure. We can see below how our client will substantially benefit from the recent changes announced in the budget and in addition, they have the option now to take as a cash refund and not offset against tax.

Brenda Donohoe, Regional Sales Director Office: +353 1 964 5325 Mobile: +353 86 319 4747

Braithwaite provides Expert R&D Tax Credit advice. We Combined Technical & Financial Expertise to Identify & Maximise your Innovation & Research & Development Tax Credit Opportunities Across Ireland

Dogpatch Labs,

The CHQ Building,

Custom House Quay,

Dublin 1, D01 Y6H7

Ireland

Office: +353 1 964 5325

Email: [email protected]

© Braithwaite Technology Consultants Limited 2025, registered in Ireland (company number 506246)